income tax calculator philippines

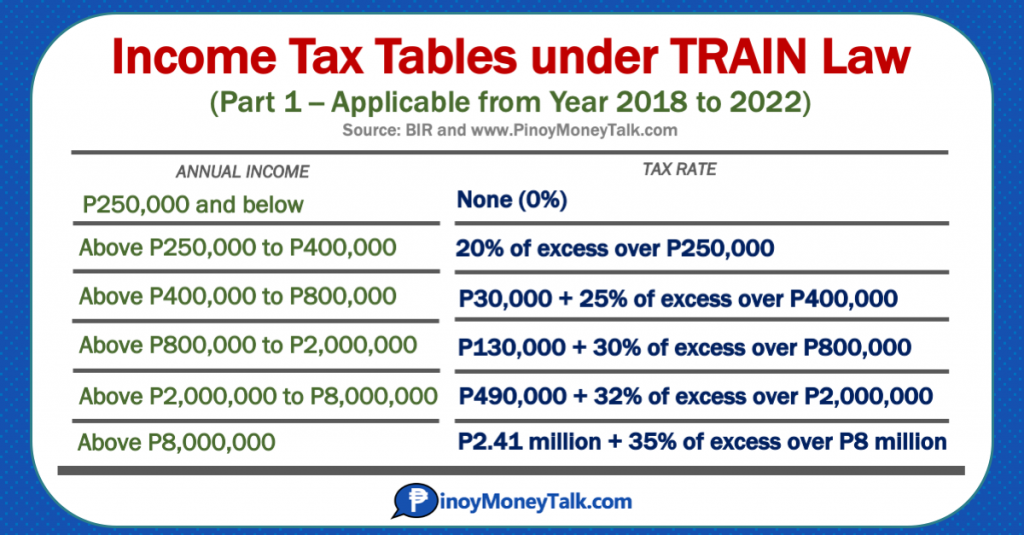

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. P25000 P58130 P31250 P100.

How To Compute Your Income Tax Using The New Bir Tax Rate Table Filipiknow

Using your taxable income compute your.

. Taxumo is the best option for digital tax filing in the Philippines. The National Tax Research Center NTRC is an agency under the DOF that conducts research in taxation to improve the tax system in the Philippines. Income Tax Rates and Thresholds Annual Tax Rate.

The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Accordingly the withholding tax. Philippines Annual Salary After Tax Calculator 2023.

Php 20000 x 12 months Php 240000. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2023 and is a great calculator for working out. Philippine Public Finance and Related.

Compute for the Income Tax. It is an ideal choice for small-scale business owners self-employed. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

Philippines Residents Income Tax Tables in 2023. Income tax rates vary depending on an individuals taxable income but in general residents of the Philippines must pay taxes on their worldwide income at a rate of 30. The Monthly Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working.

Good thing that there are online tax calculators available in the Philippines to make everything easier for you. Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens receiving income from sources within and outside Philippines fall under. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out.

Its online income tax. Tax computation in the Philippines changed. It is the 1 online tax calculator in the Philippines.

Philippines Monthly Salary After Tax Calculator 2022. Feb 05 2022 Computation of income tax due on compensation income Using the graduated tax rates. Get the annual salary.

Heres how it is computed. Philippines Annual Salary After Tax Calculator 2022. Tax Calculator Philippines 2022 1 week ago The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for.

Taxes For Self Employed Individuals In The Philippines

Small Business Tax Tips For 2022 Hp Tech Takes

Income Tax Formula Excel University

Provision For Income Tax Definition Formula Calculation Examples

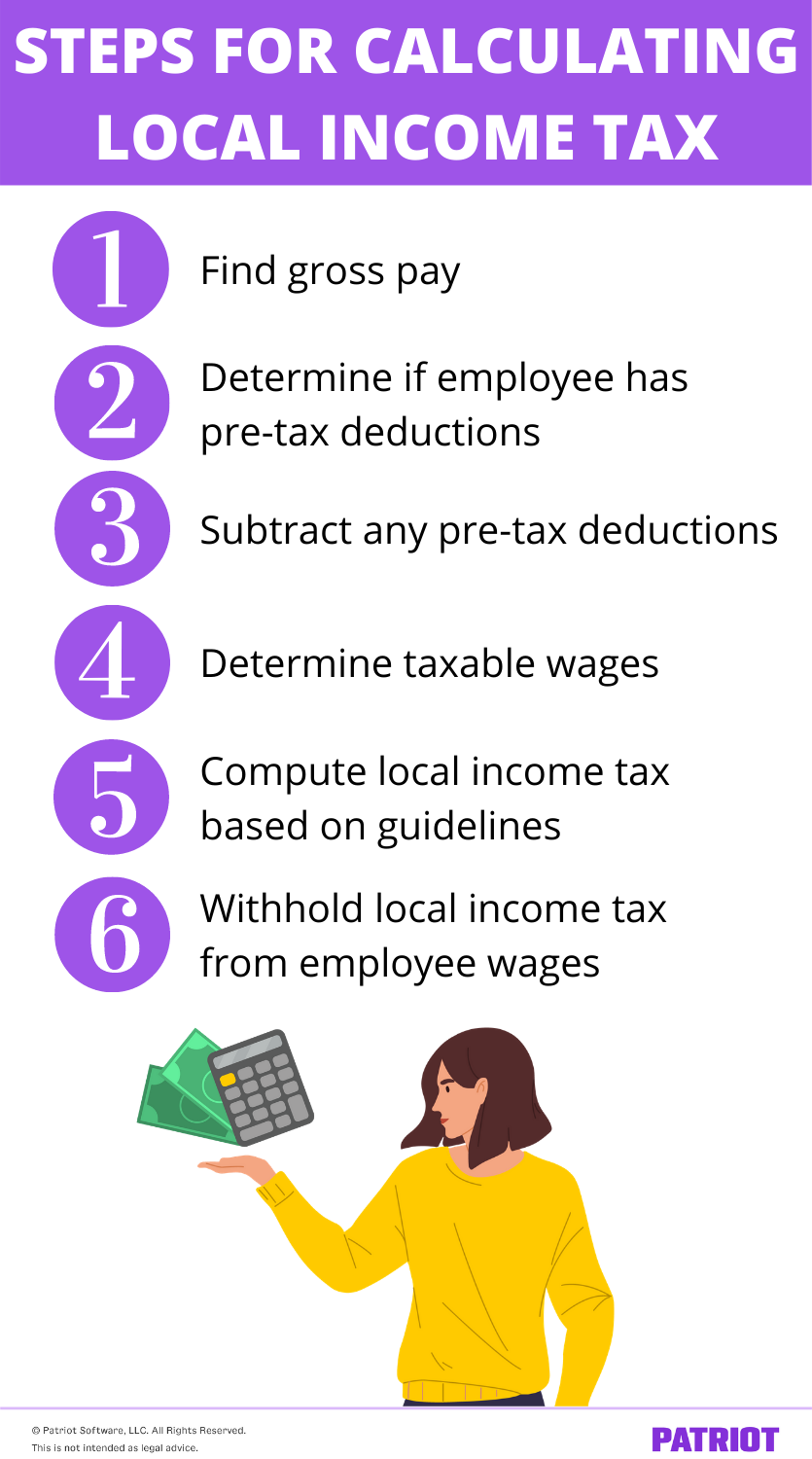

How To Calculate Local Income Tax Steps More

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

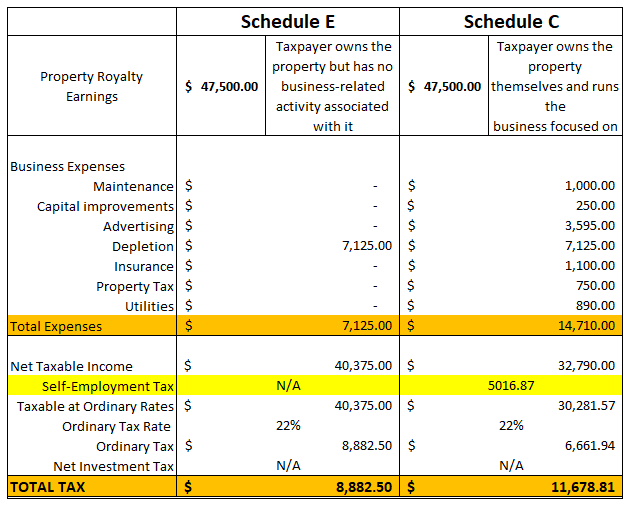

Royalty Income Taxes For 2020 With Filling Procedures Taxhub

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

![]()

Income Tax Calculator 2022 Usa Salary After Tax

Tax Calculator Estimate Your Taxes And Refund For Free

How To Compute Withholding Tax E Pinoyguide

New Income Tax Table 2022 In The Philippines

Bir Tax Calculator Factory Sale 57 Off Oldetownecutlery Com

Portion Of 2020 Unemployment Benefits Exempt La Income Tax

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

How To Calculate Gross Income Per Month The Motley Fool

Income Tax Calculator For Philippines Check If Your Tax And Take Home Pay Is Correct Using Our Calculator Download It Now For Free By Excel Crib Facebook